Federal Tax Credit For Electric Cars 2021 Form

All EVs receive a 7500 credit with an additional 2500. Attach to your tax return.

Understanding Federal Tax Credits For Electric Cars Capital One

January 2021 Department of the Treasury Internal Revenue Service.

Federal tax credit for electric cars 2021 form. In other words this only applies if your tax bill is worth 7500 or more. Also use Form 8936 to figure your credit for certain qualified two-wheeled plug-in electric vehicles discussed under Whats New earlier. Whats the federal tax credit for electric cars in 2021.

January 1 2023 to. Qualified Plug-in Electric Drive Motor Vehicle Credit Including Qualified Two-Wheeled Plug-in Electric Vehicles. For example if you buy an EV in 2019 but only owe 6500 in taxes thats the most you can deduct on your federal tax filing.

All-electric and plug-in hybrid cars purchased new in or. 1545-2137 Attachment Sequence No. The value of the IRS tax credit ranges from 2500 to 7500 depending on the electric vehicle in question.

Residential Federal Tax Credit Business Federal Tax Credit For Systems Installed. This credit is nonrefundable and will only offset your tax liability for a given tax year. 7500 is the maximum value but the actual size of the credit you claim cannot exceed what you owe in federal taxes.

The electric vehicle tax credit is worth up to 7500. For example if you purchased your qualifying car in January 2020 you would need to wait until you file your 2020 taxes around April 2021 to claim the credit. Canada has dubbed this incentive program iZEV the i stands for incentive and it has two tiers.

Among other things the proposal increases the maximum tax credit for an electric car to 12500 though there are several tiers to this. The federal tax credit for EVs and hybrid vehicles is capped at 7500 but not all cars qualify for the credit. The Qualified Plug-In Electric Drive Motor Vehicle Credit can be worth up to 7500 in nonrefundable credit.

How Much are Electric Vehicle Tax Credits. Your federal tax balance would then fall to 2500 owed. This is not a refundable tax credit.

It applies to plug-in hybrids or PHEV and plug-in electric EV or PEV vehicles. To claim the credit you need to fill out IRS Form 8936. At a glance it will appear simple straightforward and brief.

Battery-electric hydrogen fuel cell and longer-range plug-in hybrid vehicles are eligible for an incentive of 5000 while shorter range plug-in hybrid electric vehicles. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. Table of Contents show.

343 rows Federal Tax Credit Up To 7500. The federal tax credit for electric vehicles EVs allows you to claim up to 7500 on your returns for buying a new electric car. As part of the new federal budget the US Senate approved an amendment introduced by Senator Deb Fischer R-NE to introduce a limit on the price of electric cars eligible to the 7500 federal.

When you file your taxes youll fill out the tax form called Qualified Plug-in Electric Drive Motor Vehicle Credit. The idea in theory is quite simple All electric and plug-in hybrid vehicles that were purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Any taxpayer who purchases an electric vehicle specifically a vehicle with a plug is eligible for a credit.

If you purchased a Nissan Leaf and your tax bill was 5000 thats all you get at the end of the year. Electric cars are entitled to a tax credit if they qualify. Lets also say you purchased a Ford Mustang Mach-E in 2021 which is eligible for the full 7500 credit amount.

For instructions and the latest information. January 1 2020 to December 31 2022. Heres what you need to know about the federal tax credit and how to take advantage of it.

Size and battery capacity are the primary influencing factors.

How Do Electric Car Tax Credits Work Credit Karma

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicle Tax Credits What You Need To Know Edmunds

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

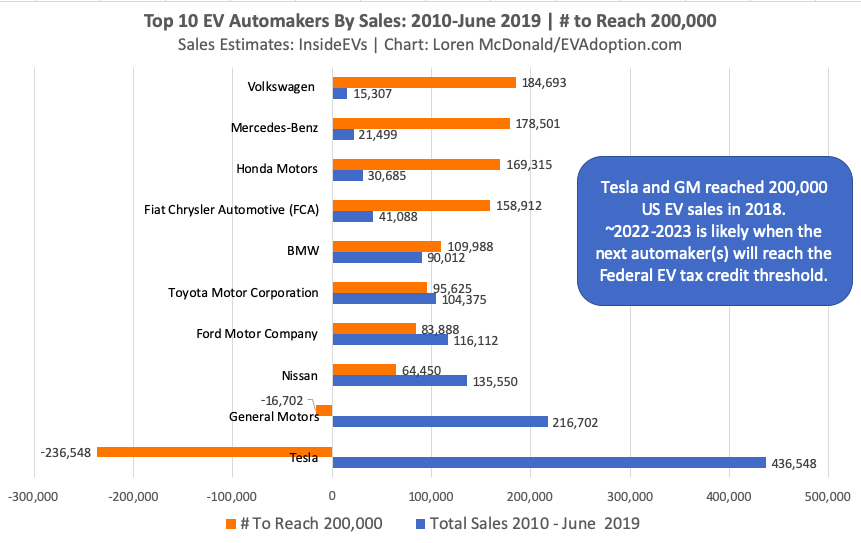

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Car And Vehicle Tax Credit What To Know Liberty Tax

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Electric Hybrid Car Tax Credits 2021 Simple Guide Find The Best Car Price

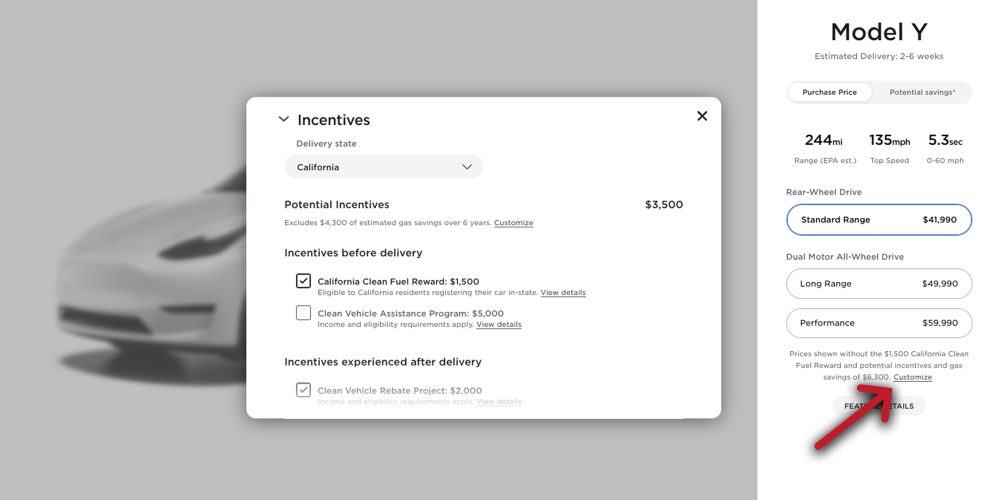

Incentives To Buy An Electric Car Greencars

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Filing Tax Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit Turbotax Tax Tips Videos

Federal Electric Car Tax Credit A Comprehensive Guide

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Car Tax Credit What Is Form 8834 Turbotax Tax Tips Videos

Post a Comment for "Federal Tax Credit For Electric Cars 2021 Form"