Federal Tax Credit For Electric Cars 2021 Lease

Unfortunately if the original owner was a dufus and did not take advantage of it when he or she purchased the car its gone for good. The credit provides up to 7500 in a tax credit when you claim an EV purchase on.

Nys Electric Vehicle Rebate At Hoselton Auto Mall In East Rochester Ny New Pre Owned And Certified Vehicles

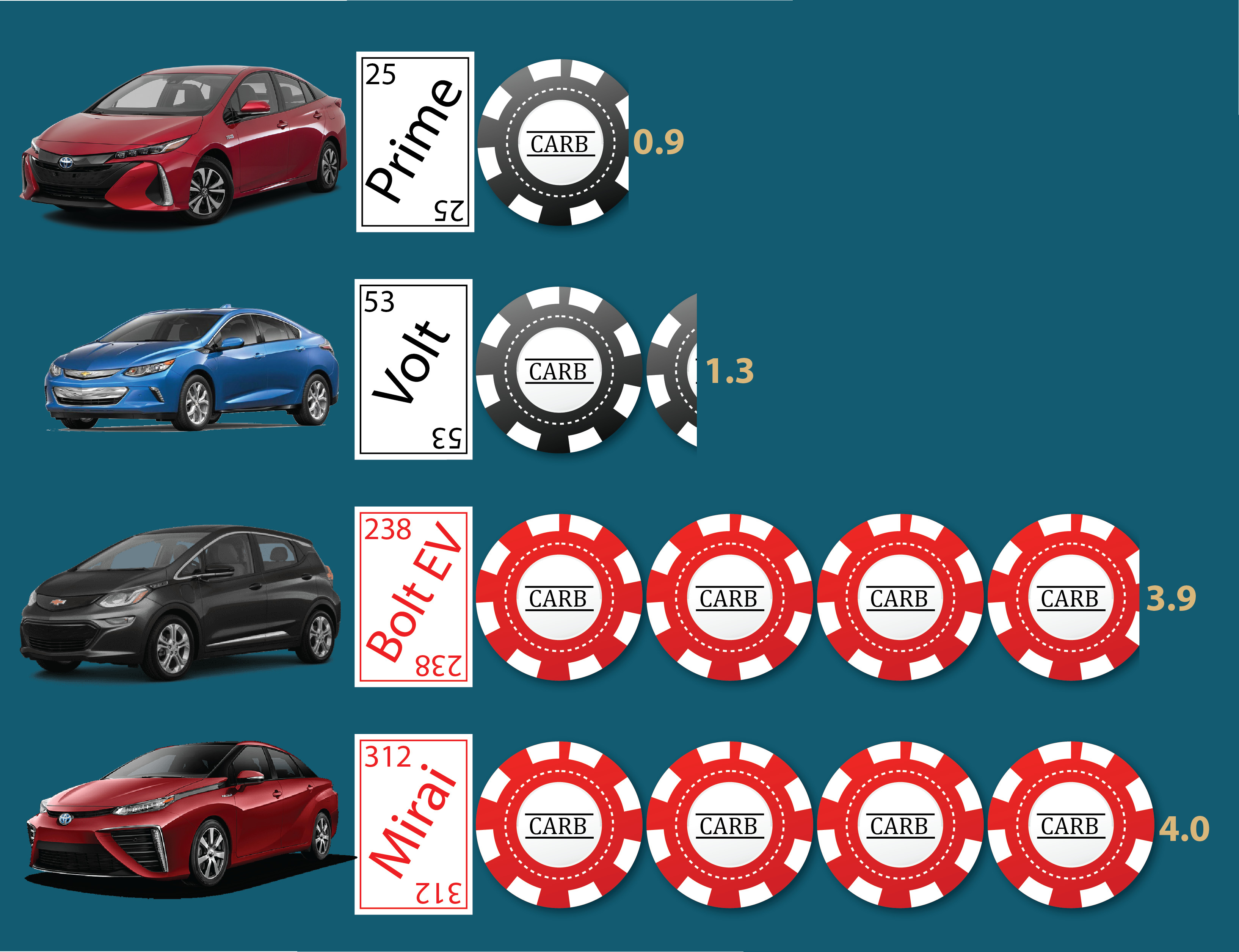

In general all electric vehicles can claim more of the credit than plug-in.

Federal tax credit for electric cars 2021 lease. You can lease an electric vehicle and take advantage. The plug-in versions of these models however do qualify. That tax credit was only worth as much as she owed the federal government and in 2019 she only owed 3829.

The electric vehicle tax credit is worth up to 7500. A new bill to reform the federal electric car tax incentive in the US has passed the US Senate Finance Committee. Federal Tax Credit gives individuals 30 off a JuiceBox home charging station plus installation costs up to 1000.

You must purchase and install the JuiceBox by December 31 2021 as well as claim the credit on your federal tax return. This is not a refundable tax credit. It includes increasing the electric vehicle tax credit to up to 12500 but it.

The Canadian federal government offers a tax credit of up to 5000 for the first registered owner of a battery-electric hydrogen fuel cell and longer range plug-in hybrid vehicles. At first glance this credit may sound like a simple flat rate but that is unfortunately not the case. The amount is determined by the power storage of the battery.

But the manufacturer might choose to include the value of the tax credit in your lease by offering a lower-priced lease. The amount varies depending on the state you live in but you can expect to receive anywhere from 500 to 5000 back with your purchase or lease. The tax credit stays with the original buyer who can take thousands of dollars in federal and state tax incentives.

A tax credit means an EV buyer will receive up to a 7500 reduction in their tax liability for the year. All-electric and plug-in hybrid cars purchased new in or. The tax credit now expires on December 31 2021.

In other words this only applies if your tax bill is worth 7500 or more. The latter really gave us the tax credits as we know them today. Shorter range plug-in hybrid electric vehicles are eligible for an incentive of 2500.

In addition to federal tax credits many states also offer rebates when you purchase or lease an electric vehicle. If you purchased a Nissan Leaf and your tax bill was 5000 thats all you get at the end of the year. Claiming the Federal Tax Credit.

The amount you receive may also be based on income eligibility. But Mueller was in for a nasty surprise. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle.

Can I Get The EV Tax Credit If I Lease. This IRS tax credit can be worth anywhere from 2500 to 7500. 343 Zeilen Federal Tax Credit Up To 7500.

If an EV buyer has a tax bill of say 3000 at the end of the year the EV tax credit can only be a maximum of 3000. Unfortunately you dont get to claim this tax credit if you lease the car. But this is a flat credit which means it is only worth the full 7500 if the individuals tax bill is at least 7500.

Electric vehicles that are eligible for incentives must have a MSRP less than 45000 in some cases and up to 60000 in others. When you buy an eligible electric car you might be able to take a federal tax credit of up to 7500. Left unchanged in the new bill are the 8000 federal tax credit for purchasers of fuel-cell electric vehicles also called hydrogen fuel-cell vehicles and the credit for home EV charging.

This tax credit could help offset the purchase price if you qualify. The IRS will not go over and. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations.

The Cheapest Electric Vehicles Car For 2019 Electric Cars Best Electric Car Hot Rods Cars Muscle

2022 Chevy Bolt Range Colors Release Date Price Chevy Bolt Chevy Models Chevy

All You Need To Know About Electric Vehicle Tax Credits Cargurus

N J Wants To Pay You To Buy An Electric Vehicle But It Hasn T Said When It Will Resume Doing So Nj Com

Electric Car Tax Credit What Is Form 8834 Turbotax Tax Tips Videos

Us Electric Car Incentive Is Rumored To Increase To 10 000 In Program Reform Electrek Electricvehicles

What Could A Biden Win Mean For Electric Vehicle Adoption In The Us Wood Mackenzie

Nissan Leaf Dealer Bay Area Lease Starting 95 Month

Electric Car Tax Incentives And Rebates Reliant Energy

All You Need To Know About Electric Vehicle Tax Credits Cargurus

N J Wants To Pay You To Buy An Electric Vehicle But It Hasn T Said When It Will Resume Doing So Nj Com

Here S Every Electric Vehicle On Sale In The Us For 2020 And Its Range Roadshow

Electric Cars Vs Gas Cars Cost Enel X

This Is How Electric Vehicle Tax Credits Work Chevy Bolt Chevy Trucks Chevy

Why Are So Many Electric Cars Still Only Sold In California

How I Got A New 2015 Nissan Leaf Electric Car For 16k Net Indecision

Post a Comment for "Federal Tax Credit For Electric Cars 2021 Lease"